Following a turbulent 2017 for staffing at all of the major auction houses, with various individuals moving around and a number stepping away from the table completely, the spring 2018 season was going to be a good test of who had faired best in all the horse trading, and show where the smart clients would consign their watches in future.

While it is easy to go through the results and pull out the lots that surpassed the expectations of the market and generated headlines elsewhere, it is not terribly useful to actually assess the relative performance of each auction house. These impressive prices can, of course, be due to the incredible condition and absolute rarity of the pieces on offer, but there is always the chance for a fluke result of an unwitting bidder not really knowing what they are raising their paddle for, or taking the advice of an inexperienced “specialist” and paying over the odds as a result.

What is far better is to take a step back, assess each auction on a case by case basis, and compare total results to benchmark relative performance, then appraise comparable watches across auction houses and locations to get a clear idea of how the teams are performing and whether they are really interacting with the top tier clients. While there are plenty of angles to view the results from, we will focus on top-end vintage Rolex and Patek Philippe references, as this is where the vast percentage of the value of the market lies at this point in time, and therefore what the houses rely on for their turnover.

House by House

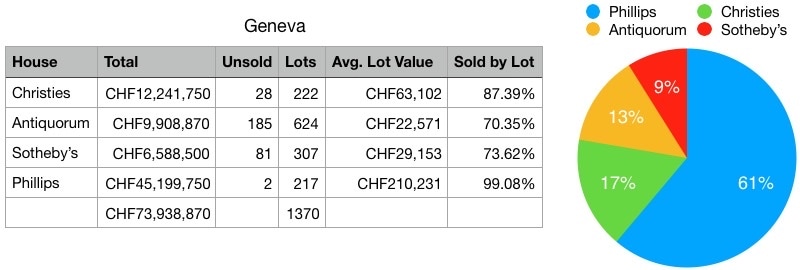

Phillips were the first to wade into battle in Geneva with the two day combo of Daytona Ultimatum on Saturday May 12th running into session one of the main sale in the evening, followed by session two on Sunday. Plenty of column inches have been dedicated to the exceptional results already, but it is best for the figures above to speak for themselves: Philiips accounted for 44% of the market in Geneva without Ultimatum included, and 61% when the thematic sale is grouped in, with only two unsold lots across both sales (one of which, the Patek Philippe reference 1518, was put through as an after sale soon after the auction, at close to the low estimate, according to reports). It is hard to find another word to describe the position of Phillips other than dominant.

The Christie’s sale was a more tricky affair, with a large portion of their tops lots hammering below the low estimates. The Patek Philippe reference 5208p estimated at 700,000 – 1,000,000 CHF sold for 600,000 CHF hammer, the reference 5539 minute repeater tourbillon estimated at 350,000 – 550,000 CHF hammered for 320,000 CHF, and the full diamond set white gold reference 5980 Nautilus estimated at 500,000 – 1,000,000 CHF sold for 490,000 CHF hammer price (the seller of which will have to wonder if it was worth getting blacklisted from Patek Philippe for that). Similar situations were observed on some of their vintage pieces, such the Cartier minute repeater from 1929 that the vendor had paid 993,500 CHF for in October 2002, which sold for 312,500 CHF inclusive of premium, and the Rolex reference 6062 star dial hammering 50,000 CHF below the low estimate.

The strongest result was the stainless steel reference 1463, with the gavel coming down just north of 400,000 CHF against an estimate of 200,000 – 400,000 CHF, but this was slightly dampened by the disappointment of the cover lot Paul Newman reference 6263 remaining unsold, after it was noted by a number of collectors and dealers that aside from the aggressive estimate of 600,000 – 1,000,000 CHF, there were a number of potential problems with the watch which were not disclosed by the auction house in their condition report.

Antiquorum continue to gain back market share after their reputation took a beating in previous years, and were able to come out ahead of Sotheby’s. The selection of Daytonas they offered were fairly indicative of what Antiquorum has in their sales: average quality that achieved middling prices.

Sotheby’s struggled again to find its feet in Geneva as they did in May 2017 when they suffered the pain of an unsold Patek Philippe Calibre 89 pocket watch. While the total result of 6,588,500 CHF is quite a way behind the competition it is still a marked improvement over last year, with the standout result of 2018 being the Rolex Paul Newman Daytona reference 6239 with beautiful tropical dial being offered by the original owner, which achieved an all-in price of 951,000 CHF against an estimate of 200,000 – 400,000 CHF. Another highlight for the team will have been the Graff diamond set tourbillon watch with cufflinks, ring and pen, which achieved 555,000 CHF inclusive against 150,000 – 250,000 CHF estimate, showing a broader client base than one would usually expect in Geneva.

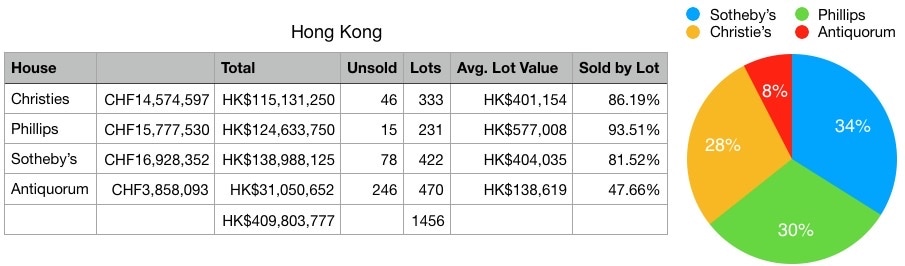

Moving on to Hong Kong, and Sotheby’s took their usual slot in April, just over a month before their main rivals. Through brute force, the Hong Kong sale was the biggest total in recent history from any of the houses in Asia, bringing in the equivalent of nearly 17M CHF. But with nearly 100 lots more than Christie’s, and the best part of 200 more than Phillips, one has to wonder if the sale was more carefully curated; perhaps a similar result could have still be achieve without the large quantity of low value lots scattered throughout the catalogue (more on this later).

While the Paul Newman Daytona with “lemon” dial (5.76M HKD all-in against an estimate of 3.2M – 6M HKD) and the white gold Patek Philippe reference 5970 with bracelet and Breguet numeral dial that previous belonged to Eric Clapton (4.92M HKD all in against an estimate of 2.4M – 4M HKD, guaranteed by the house) performed very well, there were a number of high value casualties including a reference 5002 Sky Moon Tourbillon in pink gold (estimate 7.8-12M HKD), and a reference 5004 with believed unique black pulsation scale dial (5.5-12M HKD) that did not find homes on the day, most likely due to the strong estimates. It is sometimes worth the house taking these risks when an important client has high expectations as there is always the possibility that they may find a buyer on the day. In addition, the steel reference 1579 which performed well, bringing in 8.76M HKD inclusive, left a few people wondering whether the watch would have been more suited in Geneva (helping to make up some of the difference against the competition in Switzerland).

In the consecutive May sale days, Christie’s were up before Phillips, with a decent, if somewhat ordinary, Hong Kong sale consisting predominantly of modern watches, and strong results for complicated watches from Richard Mille, Audemars Piguet, and Patek Philippe contributing the lion’s share of the total. The one great surprise was not only to see a second example of the exceedingly rare Rolex Paul Newman Daytonas with “lemon” dial after the one sold at Sotheby’s the month before, but that the result would be so exceptional, (perhaps anomalous based on previous results) with the gavel finally falling for an all-in price of 9.82M HKD (approximately 1,243,300 CHF).

Last for the season between Geneva and Hong Kong was Phillips which, with a new team in place in the region, took the bold but long requested move of putting together a tight sale that mainly consisted of vintage, resulting in perhaps the biggest sale of its kind in Asia since the legendary Sporting Time Rolex sale at Sotheby’s Hong Kong in May 2002. As they say, without risk there is no reward, and on this occasion it certainly paid off: a sell through rate of 93%, a figure not seen in a HK main sale in recent memory, and an average lot value of 577,000 HKD, over 72,000 CHF, up by over 50% from the figure for Phillips Hong Kong last year. In contrast, the results for Antiquorum bear little consideration as they make up such a small part of the market in Asia now.

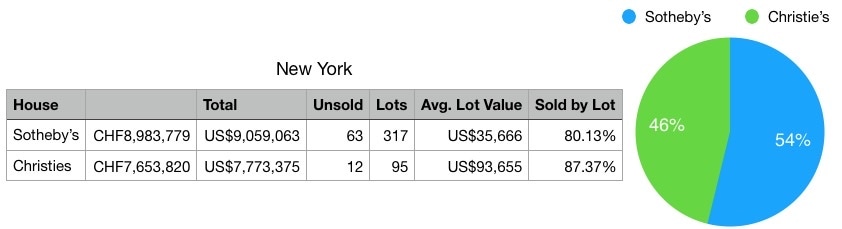

Last stop on the international circuit was New York. Sotheby’s moved their sale back a few weeks in order to accommodate refurbishing their sales rooms, but it did not not have a material effect on the results: just 9,000,000 USD with a total of 317 lots and a 80% sell through rate. Stand out results came in the shape of a platinum Richard Mille RM008 (423,000 USD all in), a Patek Philippe 5020 in white gold (250,000 USD inclusive) and a pair of Frères Rochat singing bird boxes (519,000 USD including premium). On the vintage Rolex side, there was a decent (if rather serviced) 6241 Paul Newman that made 193,750 USD all-in, and an extremely well-preserved Mark 3 1665 Double Red Sea Dweller which brought in 100,000 USD including premium. The rest of the sale was a bit long in “filler” lots, but overall a solid performance, showing the strong base for Sotheby’s in NY.

Christie’s took a rather different approach and while the dollar total was lower, it was a much more efficient, tighter sale, achieving only 1.3 million dollars less than their rivals, but with less than a third of the watches: 95 lots at Rockefeller Centre vs 317 over on the Upper East Side, resulting in an average lot value that was the best part of three times higher. Sections of the auction were rather heavy on pocket watches, a market which is all but disappearing, except in some very esoteric niches, and other areas featured a number of modern watches at “full-fat” estimates (such as the 5951P and 5040G with salmon dial, both unsold), but the star lots proved what the market is so hungry for: fresh-to-market, continuous history watches in very strong, unrestored condition. From the Omega Speedmaster reference 2915 which achieved 324,500 USD with premiums, the ex-Mel Blanc Patek Philippe reference 2499 4th series making 552,500 USD all-in, the Rolex reference 6263 Paul Newman bringing in 732,500 USD (a record for the reference in this configuration without tropical dial and outside of a thematic sale) and, of course, the new world record holding Submariner reference 6538 breaking the million dollar mark.

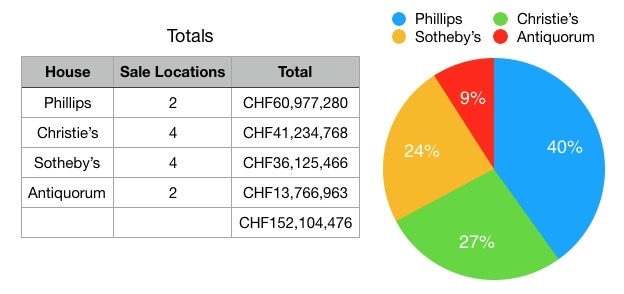

So when the dust has settled we are left with a total market valuation for the season of just over 152 million Swiss Francs, and the pecking order as follows, once the Sotheby’s London and Christie’s Dubai results have been rolled in (but excluding online sales):

The Death of the Low End

Having looked at all of the major sales on an individual basis, perhaps it is time to pull out a few observations and themes that may play out in the coming seasons.

While historically we have seen auctions, especially in Hong Kong, loaded up the the eyeballs with “filler lots” i.e. modern commodity watches, to make the live sales appeal to a wider audience, it has caused a huge issue as clients’ attentions wane, slow bidding leading to pedestrian lots dragging on and important pieces being delayed, irritating clients who often had to wait hours for the watches they were actually interested in.

It has become increasingly clear that it does not make sense for the auction house and its team to waste their time on low value lots, where the amount of energy required by the junior members to catalogue and arrange photography of the watches cannot pay dividend. Whilst it may be required to take these lesser pieces to secure a consignment, they are far better suited for an online auction with lower overheads (Sotheby’s and Christie’s are equipped here) or selling through other avenues, such as forming a partnership with one of the new large-scale watch dealers, like The WatchBox or Watchfinder (the latter having recently been acquired by Richemont).

It is clear that the days where auctions consisting of throwing enough mud at the wall for some of it to stick, with 600 plus lots and 60% sell-through rates, are coming to an end, fast. What the market is really hungry for is a return to the glamour of a tightly curated sale comprising less than 250 lots, all of exceptional quality and condition, but not necessarily all in the six figure Swiss Franc range, with a catalogue of the quality to match, so the vendors and buyers feel that they are getting value for money on their commission and 25% premium.

Pandas Hold International Appeal when in Great Condition

It is understandable that some people are getting Paul Newman Daytona fatigue, but thanks to the magic mix of relative rarity for the best condition and provenance, a romantic back story, and certified trophy asset status, the appetite for brand PN shows no signs of abating.

There were many examples that performed poorly this season, but their condition was the deciding factor for the discerning bidder, and the best-of-the-best really shone. For a quick benchmark, let’s take a look at the reference 6263 examples that graced the rostrum this spring; we have already discussed the unsold example at Christie’s and its plethora of problems, but there was another compromised example this season in the Sotheby’s Hong Kong sale with heavily damaged “tropical” dial which sold for around 260,000 CHF equivalent all-in.

Of course, the example in Phillips’ Daytona Ultimatum did exceptionally well, bringing in 756,500 CHF inclusive of premium, a record for the reference without a tropical dial. The two useful benchmarks for the market are the example from the Phillips Geneva main sale, which was sold by the son of the original owner and was in very attractive condition (aside from service pushers and chronograph hand), with mark 1 dial, which achieved 492,500 CHF inclusive of premium, and the one sold in the Phillips Hong Kong sale, also very well preserved and coming from a well-regarded collector in the region in “full spec” condition (i.e. no service parts), with mark 1.5 dial that is starting to turn tropical in places, making 550,600 CHF equivalent all-in.

The Hong Kong result was accompanied by a number of other strong prices for pump pusher Paul Newmans, proving that no matter where these watches are offered, if the condition is great, the results will be strong.

The Market Expectation is Insane

Even before the hammer fell on the last lot of the Daytona Ultimatum sale, the chat groups were lighting up with a collective groan from collectors of how the results were not as exceptional as everyone had hoped for. It’s worth remembering that the Christie’s Daytona Lesson One auction in November 2013 achieved 12M CHF for 50 lots. For the latest thematic dedicated to this model, if we remove the Arabian Knight, Neanderthal and Unicorn, due to the fact that there were no comparable watches in Lesson One, we get 11.3M CHF for 29 lots, a 1M CHF difference with a bit over half the lots.

It says a huge amount about the market that people feel disappointed with these results, where a JPS can go from 389,000 CHF to 912,500 CHF, and an RCO rises from 989,000 CHF to 1,662,500 CHF. It has to be expected that these are the same people complaining when they sell a watch for 400,000 CHF, which they bought for 200,000 CHF less than five years ago, instead of making the 500,000 CHF they were hoping for. A little perspective would go a long way at times like this.

It’s Not All Doom and Gloom When it Comes to Vintage Patek Philippe at Auction

While there have been no shortage of people saying the sky is falling for vintage Patek as every new collector is focused on Rolex, since they can pair them more easily with their Off-White VaporMaxs for the sickest Instagram photo, the results in Geneva and Hong Kong prove that there is still a decent amount of depth to the market for collectors looking for absolute top condition and rarity from the house of the Calatrava cross, and don’t suffer the insecurity that requires them to immediately blast it all over social media.

The 1436 split-second chronograph in Phillips Hong Kong was a notable result, as it is a relatively unpopular reference due to its small size, but the condition of the example offered was really exceptional, being preserved in the same state as when it was offered in 1999 (when it sold for 170,700 CHF) and in 2004 (when it made 366,500 CHF). This year it made 4,060,000 HKD all in, approximately 513,700 CHF.

Another standout from Hong Kong was the believed unique reference 2526 with black lacquer dial and Arabic numerals. Having appeared in the market a number of times over the past 25 years, first in 1993 when it sold for 149,500 HKD (approximately 28,390 CHF), then in 1999 when it remained unsold against an estimate of 55,000 to 65,000 CHF, then again in 2012 where it made 111,000 CHF, before finally gracing the Phillips sale in Hong Kong, achieving 2,375,000 HKD (just over 300,000 CHF) inclusive of premium.

In Geneva we had the fresh to market 2499 4th series with champagne dial which made 1,572,500 CHF all-in against an estimate of 800,000 – 1,600,000 CHF, and the enamel reference 1415 achieving 972,500 CHF, most surprising because it was sold only two years ago for 730,000 USD (approximately 704,000 CHF at historic rates), meaning the vendor will have made a bit of a return on this relatively short term trade.

The biggest challenge is that very few collectors wants to bring the best-of-the-best vintage pieces from Patek Philippe to market given the risk that the prices will be relatively weak, but as the above figures show, if we pick through the results, we can see that there are still aggressive bidders who can identify quality and scarcity when it surfaces.

Bonus Benchmarks: 3939, 5275, 5207

It was fortunate that this season had a number of duplicates across the houses and locations for rare, complicated, modern watches from Patek Philippe, which prove as a useful benchmark for relative performance. While position in the auction cycle, completeness of accessories, and whether the watch is single or double sealed can all have an impact on the final result, the figures are shared below for individual interpretation:

| 3939P | 2,250,000 HKD (approx. 285,000 CHF) at Christie’s (missing documentation) | vs | 2,860,000 HKD (approx. 362,000 CHF) at Phillips Hong Kong |

| 5207P | 509,000 CHF at Antiquorum (single sealed) | vs | 516,500 CHF at Christie’s |

| 5275P | 377,000 CHF at Antiquorum (single sealed) | vs | 3,700,000 HKD (approx. 468,000 CHF) at Phillipe HK (double sealed) |

| 5575G | 97,500 CHF at Antiquorum Geneva (single sealed) | vs | 112,500 CHF at Phillips Geneva |

| 5975G | 52,500 CHF at Phillips Geneva (open) | vs | 55,000 CHF at Antiquorum Geneva (single sealed) vs 525,000 HKD (approx. 66,400 CHF) at Phillips Hong Kong (open) |

With Phillips’ second New York sale taking place in October, the return of the Bonhams watch department in Hong Kong with an ex-Sotheby’s team, and all of the current players looking to consolidate their position and gain market share over their competitors, the autumn 2018 season is certainly shaping up to be an interesting one.